The Culture Committee (AKA Culture Club) identified themes from the culture survey responses that merit either more clarity and/or action. We will be putting out a series of articles to elaborate on these themes which will include the following topics:

- Compensation, including wages increases and benefits

- Financial insight regarding the agency’s structure, operating results

- Employee recognition

- Training and wellness

- Agency communication

- Supervisor training and development

This article will address the topic of compensation. As mentioned above, the issues based on survey responses had to do with wages, raises and benefits.

Wages

Two key questions around wages regularly come up – “How are our pay levels determined?” and “Why can’t I be paid more?”

Our pay ranges are determined in two steps. The first is benchmarking some positions externally. We use more common roles such as direct care staff, case managers etc. that offer direct comparison with other organizations. For market data we use several sources. We participate in published surveys including national industry surveys such as the one from The Alliance, along with local surveys from the area human resources association, counties, etc. We also rely on anecdotal data points like job ads from our competitors and discussions with others in the field who are willing to share their pay ranges. From there we build a hierarchy of positions which considers how much responsibility or accountability a given position has, along with the training, education or experience required. When this is all put together it results in a list of job titles by pay grade and pay ranges for each grade.

Contracts drive what we can ultimately pay staff. As we respond to contract opportunities or negotiate renewals with existing providers, there is a great deal of pressure on expense, and pay is the largest component of our cost of doing business. In regards to paying staff more, we have to face the reality of what purchasers are willing to pay for our services. We are fortunate that we have typically not faced cuts in funding, but even a frozen rate creates a pinch point for us when other costs – such as utilities, supplies, etc. – go up.

One of the opportunities for us to boost our wage profile is to find more preventive services with a definitive savings or pay-back. These are considerations which are part of our process for evaluating new revenue opportunities. As we look to explore, identify and develop new services we are considering the reasonableness and stability of the revenue stream associated with those services. Another opportunity is to leverage our outcomes as one way to demonstrate value for purchasers versus a focus on the cost of the service. If we can be in a position to demonstrate that we are good at what we do – and perhaps better than others in our field – it gives us a chance to negotiate more favorable rates.

Raises

We addressed annual increases in a recent message, and confirmed a decision on this would be deferred until July. Our financial results did not allow us to offer increases in the first quarter, and we will revisit the topic later in the year. We are also looking at alternatives to annual increases that may be more manageable financially but still demonstrate the agency’s recognition of the commitment of our staff.

Benefits

The most provocative component of our benefits coverage is the medical plan. This impacts us in two notable ways.

First, the cost of medical care and medical coverage is one of the fastest growing components of the US economy, and a significant cost for FCC. Accordingly, plans are continually modified to balance cost of the plan and reasonable coverage. We evaluate alternatives each year, including providers and plan designs. As we go through this process we ask providers to give us models to show the impact of various alternatives, and our current plan has shown to be our best all-around option.

FCC’s plan is a High Deductible Health Plan (HDHP) which is an increasingly popular plan in the marketplace. One of the beneficial provisions of an HDHP is that we can offer a health savings account which helps cover out of pocket expenses for a wide range of medical-related expenses such as office visits, prescription and non-prescription medications, dental care and eyeglasses. One of the most attractive features of the health savings account is the balance can continually grow – versus use it or lose it each year. FCC makes pre-tax contributions each month to the health savings account – $75 per month for single coverage and $150 for family coverage. We are fortunate that our plan premiums have not increased for the past two years, without having to increase deductibles or out of pocket limits.

Second, because of the significant cost of medical coverage employers increasingly limit the number of full time positions and FCC is no exception. The expense impact of the medical coverage is significant – family coverage is nearly $15,000 annually and single coverage around $5,500. Our monthly bill for the medical plan, combined for all employees who take it, is around $50,000/month. We continually look at opportunities to increase full time, benefit-eligible positions when possible, but this will be an on-going challenge as we negotiate with purchasers who typically face similar circumstances.

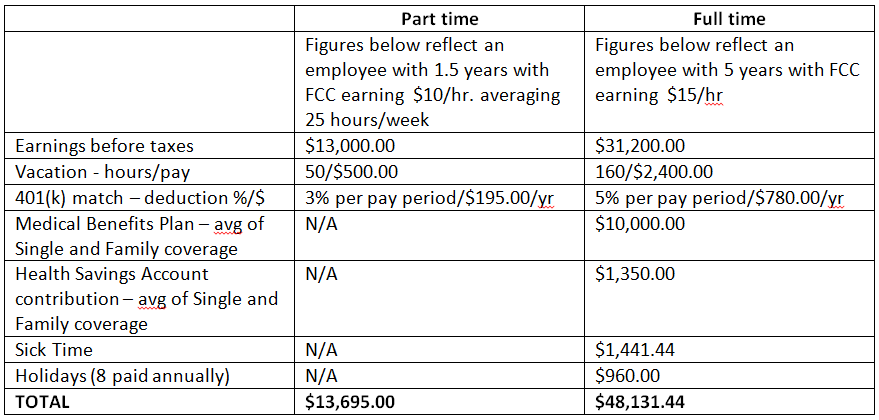

The following two examples illustrate the total annual economic impact of staff compensation, particularly the cumulative expense difference for a part time vs a full time position. We have listed the potential elements of compensation that apply to both full time and part time positions based on their tenure and pay. Of course the actual economic value could be different based on what you choose to participate in, but it is a powerful illustration of both the total compensation all employees receive as well as the expense impact of full time positions.

If you have further questions about wages, raises or benefits please contact Rich Petro or Melissa Duin.